Sage 300 People – Company Management refers to the module or feature that allows you to input and configure various aspects of a company, such as company details, codes, types, currencies, HR management settings, and official company rates. It provides tools for organising and managing essential company information within the Sage 300 People software system.

Company Details

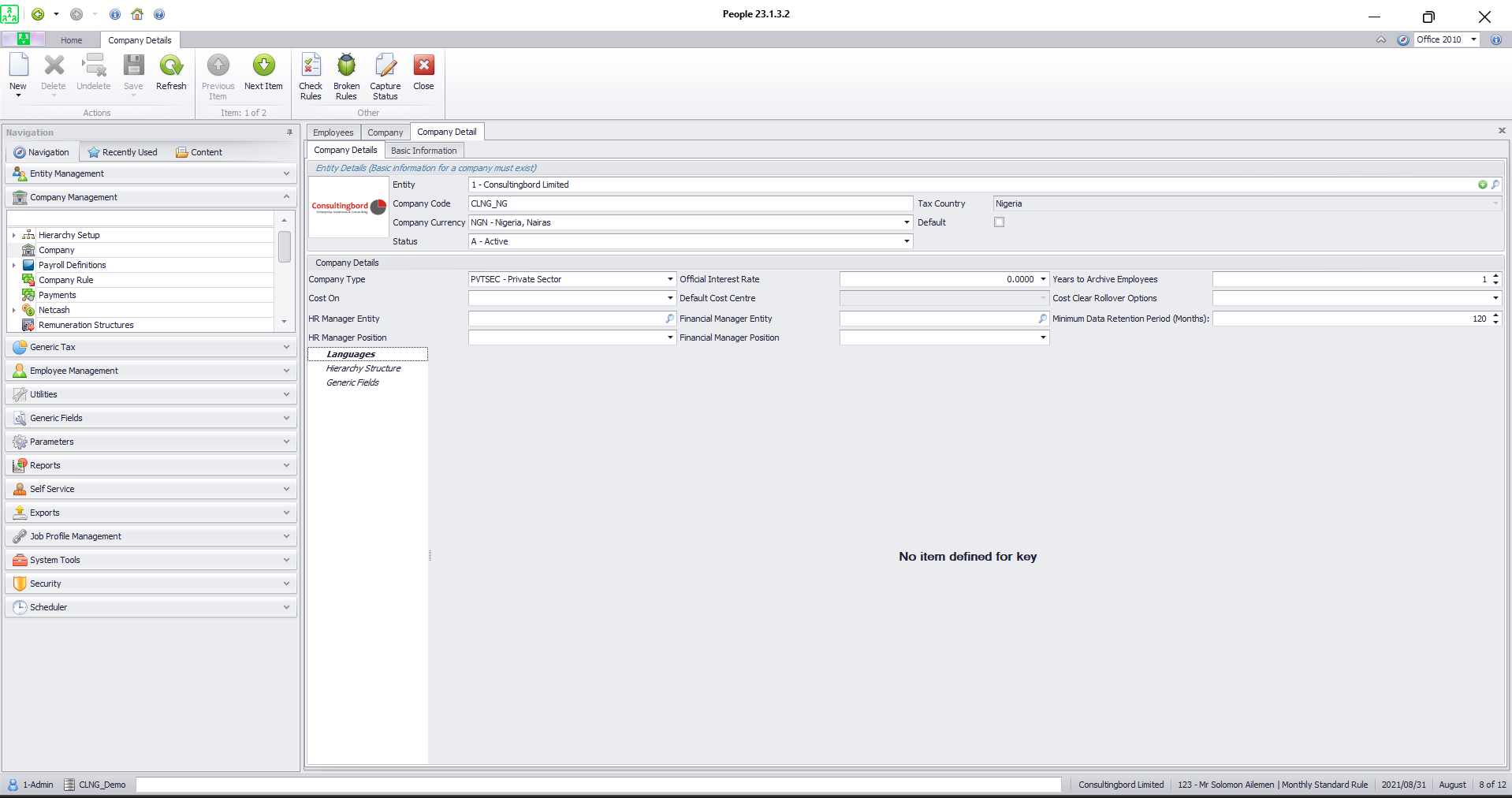

The Company Details screen contains company details such as the company registration number, entity code, tax country, address, contacts, etc. The information on this screen will be completed when setting up a new company.

To access the Company Details screen, from the Navigation pane:

- Expand the Company Management option.

- Double-click on the Company option.

- Double-click on the applicable company record.

The following screen displays:

Fields on the Company Details screen:

Entity

This field indicates the entity to which the company is linked.

Company Code

Enter a unique code for the company. The code may be up to a maximum of 15 characters.

Company Currency

Select the currency for the company.

Status

The status can either be Active or Inactive. An active entity is one that is being used and an inactive entity is no longer being used in the system.

Tax Country

This field indicates which country legislation will be applied. The tax country determines which fields become mandatory for legislative purposes, as well as certain system defaults, for example, UIF and SDL percentages.

Default

Tick the box if this is the default company in the system. The result of this will be that, whenever a company rule or payroll definition is added, and you press the spacebar in the specific field, this will be the company to which the company rule or definition will default.

Company Details section:

Company Type

This option allows you to add a specific company type, for example, Private Sector or Public Sector.

Cost on

Select the cost type that must be available for the company.

The options are:

- Hierarchy Header: This option allows you to define the employee’s cost split on the Cost screen and cost on one hierarchy header.

- Cost Centre: This option allows you to define the employee’s cost split on the Cost Centre screen and allows you to apply costing on more than one hierarchy header. Cost centre definitions must be created before the cost allocations may be defined.

- Cost All: This option allows you to use both cost options for the company.

HR Manager Entity

To link the responsible entity, click on the Locate button.

HR Manager Position

Link the HR Manager position. The information of the employee linked to the position will be used in the report.

Official Interest Rate

Enter the official interest rate. This rate will be used to determine the taxable fringe benefit for low or interest-free loans.

Default Cost Centre

This option allows you to select the cost centre that must default for all employees on the Cost Centre screen.

Financial Manager Entity

To link the responsible entity, click on the Locate button.

Financial Manager Position

Link the Financial Manager position. The information of the employee linked to the position will be used in the report.

Delete Employee Years

This field indicates the number of years after which employee history may be deleted from the system.

Cost Clear Rollover Options

Select whether the costing allocations and any exceptions should clear when a rollover is done.

The options are:

- Do not clear: This option will not clear any allocations and/or exceptions made. This will be the default option when no selections have been made.

- Clear all costing exceptions: This option will clear both the cost allocation and cost centre allocation exceptions.

- Clear only cost centre exceptions: This option will only clear the cost centre exceptions.

- Clear only hierarchy cost exceptions: This option will only clear the cost allocation exceptions.

- Clear all cost centre allocations and exceptions: This option will clear the cost centre allocations, as well as the cost centre allocation exceptions.

- Clear all hierarchy cost allocations and exceptions: This option will clear the cost allocations, as well as the cost allocation exceptions.

- Clear all cost allocations and exceptions: This option will clear all cost allocations, all cost centre allocations and the exceptions for both.

Minimum Data Retention Period (Months)

Enter the minimum number of months that the data contained in the database is legally required to be retained before it may be deleted.